Choosing the right accounting software is crucial for small businesses. The right tool can simplify financial tasks and save time.

Many small business owners struggle with accounting. They often need a solution that is easy to understand and use. With various options available, it can be overwhelming to find the best fit. The right accounting software should help track income, expenses, and invoices without causing stress.

A user-friendly interface can make this process smooth and efficient. This blog will explore the best easy-to-use accounting software for small businesses. Each option will focus on features, affordability, and user experience. This way, you can find the perfect tool to help manage your finances effectively.

Credit: howtostartanllc.com

Introduction To Easy Accounting Software

Easy accounting software helps small business owners manage their finances. It simplifies tracking income and expenses. This software reduces stress and saves time. Many options exist, making it easier for everyone.

The Need For Simplified Accounting

Small businesses face many challenges. Managing finances can be overwhelming. Time is precious for owners. They want to focus on growing their business.

Complicated accounting tasks can lead to mistakes. Errors can cost money and waste time. Simple accounting solutions help avoid these issues. They make financial management clear and easy.

Impact On Small Businesses

Easy accounting software can change how small businesses operate. It helps owners understand their financial health. With better insights, they can make informed decisions.

Streamlined accounting processes save time and effort. This allows business owners to focus on customers and products. Increased efficiency can lead to growth and success.

Many small businesses report improved cash flow. Easy-to-use software helps track payments and invoices. This ensures timely payments and better cash management.

Credit: online.jwu.edu

Key Features Of User-friendly Accounting Software

Choosing the right accounting software is crucial for small businesses. The best software makes accounting simple. It helps you manage finances easily. Here are some key features of user-friendly accounting software.

Intuitive Interface

An intuitive interface is essential for easy navigation. A clean design helps users find what they need quickly. Here are some important aspects:

- Clear dashboard overview

- Simple menu structure

- Easy access to reports

- Responsive design for mobile use

These features allow users to perform tasks without confusion. A user-friendly interface reduces errors. Less time is spent on learning how to use the software.

Automation Of Routine Tasks

Automation saves time and reduces manual work. The right software automates many tasks. This feature helps small businesses focus on growth. Here are some tasks that can be automated:

- Invoice generation

- Expense tracking

- Payment reminders

- Bank reconciliation

With automation, fewer mistakes occur. Users can set up recurring invoices. Payments can be tracked automatically. Overall, automation leads to a smoother accounting process.

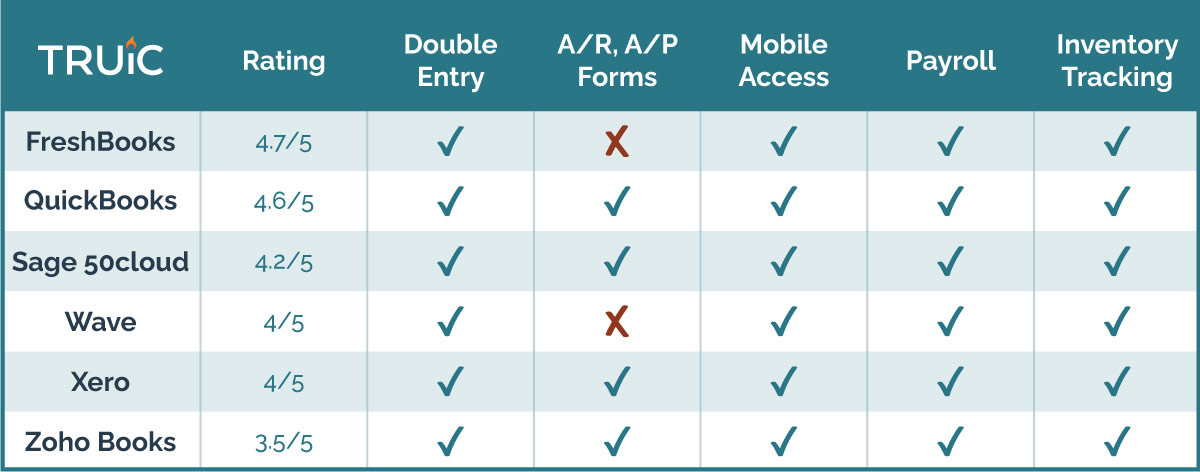

Top Choices For Small Business Accounting Software

Finding the right accounting software is crucial for small businesses. The right tool simplifies financial tasks. It helps track expenses, manage invoices, and understand cash flow. Here are some top choices that cater to different needs.

Affordable Options For Startups

Startups often face tight budgets. They need software that is cost-effective. Here are some affordable options:

| Software Name | Price per Month | Key Features |

|---|---|---|

| Wave | Free | Invoicing, receipt scanning, accounting |

| FreshBooks | $15 | Time tracking, invoicing, expense tracking |

| ZipBooks | Free | Basic bookkeeping, invoicing, reporting |

These tools offer essential features without high costs. They are easy to use and suitable for beginners. Startups can focus on growth without financial strain.

Scalable Solutions For Growing Enterprises

As businesses grow, their accounting needs change. They require more features and support. Here are scalable solutions:

- QuickBooks Online

- Plans start at $25/month

- Comprehensive reporting

- Inventory management

- Xero

- Plans start at $11/month

- Multi-currency support

- Integration with over 800 apps

- Sage 50cloud

- Plans start at $46.50/month

- Advanced inventory features

- Robust security options

These solutions grow with your business. They offer advanced features and integrations. Businesses can manage finances more effectively as they expand.

Credit: www.linkedin.com

Cloud-based Accounting Software Advantages

Cloud-based accounting software offers many benefits for small businesses. It makes managing finances easier and more efficient. This software is available from any device connected to the internet. Let’s explore some key advantages of using this type of software.

Accessibility And Collaboration

Accessibility is a major benefit of cloud-based accounting software. Users can access their accounts anytime, anywhere. This allows business owners to check finances on the go. Team members can work together in real-time. No need to be in the same location. They can share files and update information easily.

Collaboration becomes seamless. Multiple users can edit documents at once. This reduces delays in communication. Everyone stays on the same page. This leads to better decision-making for the business.

Data Security And Backups

Data security is critical for any business. Cloud-based software provides strong protection for financial data. Most services use encryption to keep information safe. Regular backups ensure no data is lost. This gives peace of mind to business owners.

In case of hardware failure, data remains secure. Users can recover information quickly. Cloud services also monitor for threats. They protect against cyberattacks. This level of security is hard to achieve with traditional methods.

Integration With Other Business Tools

Integration with other business tools is crucial for small businesses. The right accounting software can connect with various applications. This connection streamlines tasks and saves time. It allows for better data management and improves overall efficiency.

Seamless Workflow With Crms

Customer Relationship Management (CRM) systems help manage customer interactions. Integrating accounting software with CRM systems is beneficial. It creates a seamless workflow between sales and finance teams. Here are some key benefits:

- Real-time data updates: Changes in sales reflect in accounting instantly.

- Improved customer insights: Access financial data while viewing customer information.

- Streamlined invoicing: Generate invoices directly from customer records.

Popular CRMs like Salesforce and HubSpot offer integrations with accounting software. This integration helps small businesses track sales and financial health together.

Synchronization With Payment Systems

Payment systems are essential for small businesses. They handle transactions and receive payments. Connecting accounting software to payment systems simplifies this process. Key advantages include:

- Automatic transaction recording: Every payment automatically updates in the accounting system.

- Reduced manual errors: Less chance of data entry mistakes.

- Faster reconciliation: Quickly match payments to invoices.

Popular payment systems like PayPal and Stripe work well with accounting software. This synchronization helps small businesses maintain accurate financial records.

| Accounting Software | CRM Integration | Payment System Integration |

|---|---|---|

| QuickBooks | Salesforce | PayPal, Stripe |

| Xero | HubSpot | Square, PayPal |

| FreshBooks | Zoho CRM | Stripe, PayPal |

Integrating accounting software with other business tools is essential. It enhances productivity and accuracy. A seamless workflow leads to better business outcomes.

Mobile Accounting Apps For On-the-go Management

Mobile accounting apps make managing finances easy. These apps allow small business owners to handle their finances anytime, anywhere. With just a smartphone, you can track expenses, create invoices, and monitor cash flow. This flexibility helps keep your business on track.

Real-time Financial Monitoring

Real-time monitoring is crucial for small businesses. It helps you stay updated on your financial status. Here are some key benefits:

- Track income and expenses instantly

- View cash flow at a glance

- Receive alerts for important financial events

- Make informed decisions quickly

Many mobile accounting apps offer dashboards. These dashboards display your financial data in real-time. You can see trends and patterns immediately. This feature allows you to respond to changes faster.

Receipts And Expenses Tracking

Tracking receipts and expenses is essential. Mobile apps simplify this process. You can take photos of receipts and store them easily. This feature reduces paper clutter.

Here are some popular apps for tracking expenses:

| App Name | Key Features |

|---|---|

| Expensify | Receipt scanning, expense reporting, and integrations |

| QuickBooks | Expense tracking, invoicing, and financial reporting |

| Xero | Expense claims, bank reconciliation, and project tracking |

Using these apps, you can:

- Easily categorize expenses

- Generate expense reports

- Sync data with accounting software

Mobile accounting apps provide convenience. You can manage your business finances without being tied to a desk.

Support And Resources For Non-accountants

Many small business owners do not have a background in accounting. This can make managing finances challenging. The right accounting software can help. Good software offers support and resources for users. This ensures non-accountants can navigate easily.

Accessible Customer Service

Reliable customer service is vital for any software. Small business owners need quick answers to questions. Here are some features to look for:

- Live Chat: Instant help during business hours.

- Email Support: Responses within one business day.

- Phone Support: Speak to a representative directly.

- Help Center: A comprehensive library of articles and FAQs.

Choose software that offers 24/7 support. This ensures you can get help anytime.

Educational Materials And Communities

Learning about accounting can be daunting. Many accounting software options provide educational resources. These resources help users understand basic accounting principles. Here are some valuable materials:

- Tutorial Videos: Step-by-step guides on how to use features.

- Webinars: Live sessions to learn directly from experts.

- Blogs: Articles about tips and best practices.

- User Forums: Communities where users share advice and experiences.

These resources make it easier for non-accountants. They can learn at their own pace.

Overall, good support and resources are essential. They help small business owners feel confident in managing their finances.

Cost-benefit Analysis Of Accounting Software Investments

Investing in accounting software can feel overwhelming. The cost may seem high upfront. Yet, understanding the long-term benefits is essential. This analysis helps small business owners see the real value of their investment.

Long-term Savings

Accounting software offers many ways to save money over time. Here are some key points to consider:

- Time Efficiency: Automated tasks reduce manual entry.

- Reduced Errors: Less chance of mistakes saves money.

- Streamlined Processes: Quick invoicing and payment tracking helps cash flow.

Let’s look at a simple table to see potential savings.

| Cost Factor | Manual Accounting | Accounting Software | Annual Savings |

|---|---|---|---|

| Labor Costs | $20,000 | $10,000 | $10,000 |

| Error Correction | $5,000 | $1,000 | $4,000 |

| Time Savings | 500 hours | 200 hours | $7,500 |

| Total | $25,000 | $11,000 | $14,000 |

Roi For Small Business Owners

Return on investment (ROI) measures the value gained from spending. For small business owners, ROI is crucial. Here are some factors to consider:

- Initial Costs: Consider the software purchase and setup fees.

- Ongoing Expenses: Monthly or yearly subscription fees matter.

- Gains: Track savings and increased revenue from efficiency.

Calculating ROI is simple:

ROI = (Gains - Costs) / Costs x 100%

Example:

- Gains: $20,000

- Costs: $5,000

- ROI = (20,000 – 5,000) / 5,000 x 100% = 300%

Such a high ROI shows that accounting software can be a wise choice.

Making The Switch To A New Accounting System

Switching to a new accounting system can feel daunting. Many small business owners worry about losing data or confusing their staff. The right approach can make the process smoother. Proper planning helps reduce stress and ensures success.

Data Migration Considerations

Data migration is critical. It involves transferring financial data from the old system to the new one. Consider these key factors:

- Data Accuracy: Ensure the data is correct before moving it.

- Data Format: Check if the new system supports the old format.

- Backup: Always create a backup of your data before migration.

- Testing: Test the new system with sample data first.

Here are steps for a successful migration:

- Assess your current data.

- Choose the right time for migration.

- Notify your team about the change.

- Execute the data transfer.

- Review the data in the new system.

Training Staff On New Software

Training is essential for a smooth transition. Staff should feel confident using the new system. Consider these training options:

- Online Tutorials: Use videos or guides that explain features.

- Hands-On Training: Provide practice sessions for users.

- Documentation: Create easy-to-follow manuals for reference.

- Support: Ensure technical support is available during the switch.

Set a timeline for training:

| Week | Activity |

|---|---|

| 1 | Introduce the software |

| 2 | Hands-on practice sessions |

| 3 | Review documentation |

| 4 | Q&A and feedback sessions |

Invest time in training. A well-prepared team will adapt faster. This leads to improved productivity and fewer errors.

Future Trends In Accounting Software For Small Business

Small businesses face many changes in accounting software. Technology is evolving quickly. New tools help owners manage finances better. Understanding these trends can help businesses thrive.

Ai And Machine Learning Enhancements

Artificial Intelligence (AI) is changing accounting. It automates tasks like data entry. This saves time and reduces errors.

Machine learning helps software learn from data. It can find patterns and provide insights. This means smarter decision-making for small business owners.

Predictive Analytics And Financial Forecasting

Predictive analytics is a powerful tool for small businesses. It uses past data to make predictions. This helps in planning for the future.

Financial forecasting becomes easier with this technology. Business owners can see potential trends. They can prepare for challenges and opportunities.

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software for small businesses includes options like QuickBooks, FreshBooks, and Xero. These platforms offer user-friendly interfaces, essential features, and affordable pricing. They simplify invoicing, expense tracking, and financial reporting, making them ideal for entrepreneurs and small business owners.

How Much Does Small Business Accounting Software Cost?

Costs for small business accounting software vary widely. Basic plans can start at around $10 per month, while more comprehensive solutions may cost up to $70 monthly. Many providers offer free trials or tiered pricing based on features, ensuring businesses find a plan that fits their budget.

Is Accounting Software Easy To Use?

Yes, most accounting software is designed for user-friendliness. They feature intuitive dashboards, guided setups, and helpful tutorials. Even those with limited accounting knowledge can navigate these platforms effectively, allowing small business owners to manage finances without extensive training.

Can I Use Accounting Software On Mobile Devices?

Yes, many accounting software options offer mobile applications. This allows users to manage finances on-the-go, whether through smartphones or tablets. Features typically include expense tracking, invoicing, and financial reporting, providing flexibility for busy entrepreneurs and remote teams.

Conclusion

Choosing the right accounting software is important for small businesses. Easy-to-use tools save time and reduce stress. They help you keep track of your finances without confusion. Consider your business needs and budget before deciding. Many options offer free trials.

Test a few to find the best fit. A good accounting program makes managing money easier. It allows you to focus on growing your business. Take the step today to simplify your accounting tasks. Your business deserves it.