QuickBooks is a popular accounting software for small businesses. It helps manage finances efficiently.

Small business owners often face challenges in managing their finances. QuickBooks offers solutions that simplify accounting tasks. From tracking expenses to managing payroll, it provides essential tools. Using QuickBooks can save time and reduce errors. Many small businesses rely on it for accurate financial reports.

The software is user-friendly and supports various business needs. Whether you are a startup or an established business, QuickBooks can help. Explore the benefits of using QuickBooks for your small business. Understand how it can streamline your operations and improve financial health. Read on to learn more about QuickBooks and its advantages.

Introduction To Quickbooks

Every small business needs proper accounting software. QuickBooks is a popular choice. It helps manage finances efficiently. This blog post will introduce you to QuickBooks. Let’s explore why it is important for small businesses.

What Is Quickbooks?

QuickBooks is accounting software. It is designed for small and medium-sized businesses. It offers various features such as:

- Invoicing

- Expense tracking

- Payroll management

- Inventory tracking

QuickBooks simplifies financial tasks. It saves time and reduces errors. The software comes in different versions. Each version caters to specific business needs.

Importance For Small Businesses

QuickBooks plays a vital role in small businesses. Here are some reasons why:

| Feature | Benefit |

|---|---|

| Automated Invoicing | Saves time and ensures timely payments |

| Expense Tracking | Helps manage and monitor expenses easily |

| Payroll Management | Ensures accurate employee payments |

| Inventory Tracking | Keeps track of stock levels |

Using QuickBooks, small businesses can focus more on growth. Financial tasks become simpler and more accurate. QuickBooks offers tools to generate reports. These reports help in making informed decisions.

QuickBooks also integrates with various third-party applications. This integration enhances its functionality. It supports cloud-based access. Business owners can manage their finances from anywhere. This flexibility is crucial for small business success.

Getting Started

Getting started with QuickBooks for small business can seem overwhelming. But with a few simple steps, you can set up and start managing your finances quickly. This guide will walk you through the basics of setting up QuickBooks and navigating its dashboard.

Setting Up Quickbooks

To set up QuickBooks, you need to create an account first. Visit the QuickBooks website and sign up with your email. Follow the prompts to enter your business details. Make sure to provide accurate information.

Once you have an account, you can choose a subscription plan. QuickBooks offers different plans to suit various business needs. Pick the one that best fits your business size and requirements.

| Plan | Best For | Features |

|---|---|---|

| Simple Start | Freelancers | Basic accounting, invoicing |

| Essentials | Small businesses | Bill management, multi-user access |

| Plus | Growing businesses | Project tracking, inventory management |

After choosing a plan, download and install the QuickBooks software. You can also use the online version if preferred. Set up your company’s financial details. This includes bank accounts, tax information, and other financial data.

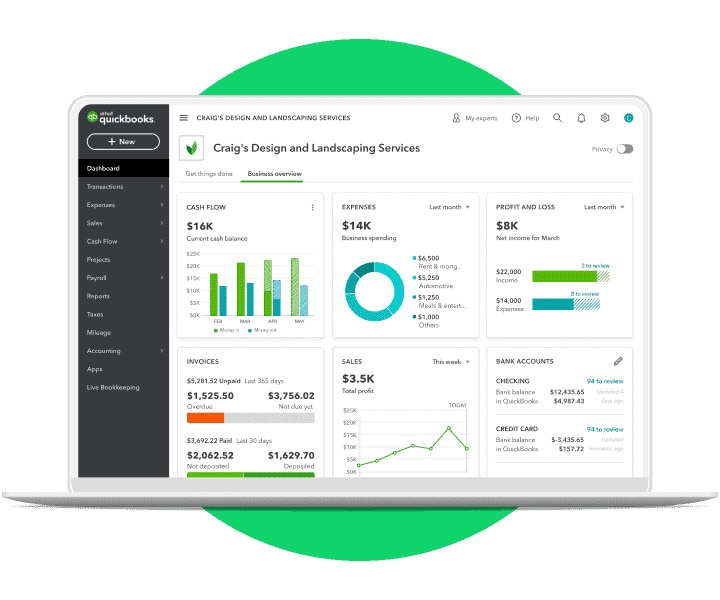

Navigating The Dashboard

The QuickBooks dashboard is your central hub. It’s where you manage all your financial tasks. The dashboard is user-friendly and designed to help you find what you need quickly.

At the top, you’ll see the main navigation menu. This menu includes options like Home, Sales, Expenses, and Reports. Click on any of these to access different features.

The center of the dashboard displays an overview of your business finances. Here, you can see your income, expenses, and profit. This gives you a snapshot of your financial health.

On the right side, you’ll find shortcuts to common tasks. These include creating invoices, managing expenses, and running reports. Use these shortcuts to save time.

- Home: Your main dashboard view

- Sales: Manage invoices and sales receipts

- Expenses: Track and pay bills

- Reports: Generate financial reports

By understanding how to navigate the QuickBooks dashboard, you can manage your finances more effectively. Start exploring each section to get familiar with all the tools available.

Managing Invoices

Managing invoices is crucial for small businesses. QuickBooks provides a seamless way to handle this task, ensuring you get paid on time and keep your cash flow steady. This section will guide you through creating invoices and tracking payments efficiently.

Creating Invoices

Creating invoices in QuickBooks is straightforward. Follow these simple steps:

- Open QuickBooks and go to the Sales tab.

- Select Create Invoice.

- Fill in the customer details.

- Add the products or services provided.

- Enter the due date and payment terms.

- Click Save and Send to email the invoice directly.

QuickBooks allows customization of invoices. You can add your logo and choose a template that fits your brand. This ensures a professional look and feel for your invoices.

Tracking Payments

Tracking payments is vital for maintaining a healthy cash flow. QuickBooks makes it easy to track who has paid and who still owes you money.

- Navigate to the Sales tab.

- Click on Invoices.

- View the status of each invoice.

QuickBooks uses clear labels like Paid, Partially Paid, and Unpaid. This helps you quickly see which invoices need attention.

For overdue invoices, you can send reminders with just a few clicks. This feature helps you stay on top of your receivables without much effort.

By efficiently managing invoices, you ensure smoother business operations. QuickBooks simplifies this process, letting you focus on growing your business.

Expense Tracking

Small businesses need to manage their expenses carefully. QuickBooks offers an easy way to track expenses, keeping your finances organized. This section will cover how to record expenses and categorize transactions using QuickBooks.

Recording Expenses

QuickBooks allows you to record expenses quickly. You can enter details for each expense, ensuring that you don’t miss any costs. Here’s how to do it:

- Log in to your QuickBooks account.

- Navigate to the Expenses tab.

- Click on the New Expense button.

- Fill in the details such as date, vendor, and amount.

- Save the expense to update your records.

Categorizing Transactions

Categorizing your transactions helps in better financial analysis. QuickBooks makes it simple to assign categories to each expense. Follow these steps:

- Go to the Transactions menu.

- Select the transaction you want to categorize.

- Choose a category from the dropdown menu.

- Click Save to update the transaction.

Here are some common expense categories:

| Category | Description |

|---|---|

| Office Supplies | Items like paper, pens, and other office materials. |

| Travel | Expenses for business trips, including hotel and transport. |

| Utilities | Bills for electricity, water, and internet services. |

By categorizing expenses, you get a clear view of where your money goes. This helps in making informed business decisions.

Bank Reconciliation

Bank reconciliation is a crucial task for any small business. It helps ensure your financial records match your bank statements. QuickBooks makes this task easier by streamlining the process. This saves you time and reduces errors.

Connecting Bank Accounts

QuickBooks allows you to connect your bank accounts directly. This feature automatically imports transactions into your QuickBooks account.

To connect your bank account:

- Log into QuickBooks.

- Navigate to the Banking menu.

- Select Add Account.

- Follow the on-screen instructions to link your bank account.

Connecting your bank accounts ensures that all transactions are recorded in QuickBooks. This helps keep your records accurate and up-to-date.

Reconciling Statements

Once your bank accounts are connected, you can reconcile your statements. This involves matching transactions in QuickBooks with those on your bank statement.

To reconcile statements:

- Go to the Banking menu.

- Select Reconcile.

- Choose the account you want to reconcile.

- Enter the ending balance from your bank statement.

- Match each transaction in QuickBooks with your bank statement.

Reconciling your statements regularly helps identify any discrepancies. It ensures your financial records are accurate and trustworthy.

By using QuickBooks for bank reconciliation, small business owners can manage their finances more effectively. This feature simplifies the process, making it accessible even for those with limited accounting knowledge.

Credit: quickbooks.intuit.com

Generating Reports

QuickBooks offers a range of features for small businesses. One key feature is the ability to generate reports. These reports provide valuable insights into your business’s financial health. They help you make informed decisions. Below, we’ll explore different types of reports and how to customize them.

Financial Reports

Financial reports are essential for any business. They offer a snapshot of your financial status. In QuickBooks, you can generate various financial reports. Some common ones include:

- Profit and Loss Statement: This shows your revenue and expenses over a specific period.

- Balance Sheet: This provides an overview of your assets, liabilities, and equity.

- Cash Flow Statement: This tracks the inflow and outflow of cash in your business.

These reports help you understand your business’s performance. They also help you prepare for tax season.

Customizing Reports

QuickBooks allows you to customize reports. This helps you focus on the most important data. You can adjust various elements such as:

- Date Range: Select the period you want to review.

- Columns: Choose which columns to display.

- Filters: Apply filters to narrow down the data.

To customize a report, follow these steps:

- Open the report you want to customize.

- Click on the “Customize” button.

- Make the desired changes.

- Click “Run Report” to view the updated report.

Customizing reports makes it easier to find specific information. It also helps you create more detailed and useful reports.

Payroll Management

Managing payroll is crucial for small businesses. With QuickBooks, this task becomes simpler and more efficient. It ensures timely and accurate payments, keeping employees happy. Let’s explore how to set up and process payroll in QuickBooks.

Setting Up Payroll

Setting up payroll in QuickBooks is straightforward. Follow these steps to get started:

- Sign up for QuickBooks Payroll service.

- Enter company information such as business name and address.

- Add employee details including names, addresses, and Social Security numbers.

- Set up pay schedules based on your payment frequency (weekly, bi-weekly, monthly).

- Define pay types such as salary, hourly, overtime, and bonuses.

- Input tax information for accurate deductions and compliance.

Processing Payroll

Processing payroll in QuickBooks involves a few key steps. Here’s a quick guide:

- Review employee hours and make necessary adjustments.

- Calculate payroll including gross pay, deductions, and net pay.

- Approve the payroll to initiate payments.

- Distribute paychecks through direct deposit or printed checks.

- File payroll taxes and generate necessary reports.

QuickBooks automates many of these steps. This reduces errors and saves time. Efficient payroll management is key to smooth business operations.

Tax Preparation

Tax preparation can be a daunting task for small businesses. QuickBooks provides tools to make this process easier. Let’s dive into organizing tax data and filing taxes efficiently.

Organizing Tax Data

Keeping tax data organized is crucial for small businesses. QuickBooks helps you categorize transactions and track expenses. This makes it easier to find the information you need when preparing taxes.

Here are some tips for organizing tax data:

- Use categories: Assign categories to each transaction. This helps you see where your money is going.

- Track expenses: Keep a record of all business expenses. This includes receipts and invoices.

- Review regularly: Check your records every month. This ensures everything is accurate.

Organizing tax data saves time and reduces stress. It also helps you avoid mistakes on your tax return.

Filing Taxes

Filing taxes is easier with QuickBooks. The software helps you gather the necessary documents. It also provides reports that summarize your financial data.

Steps for filing taxes with QuickBooks:

- Generate reports: Use QuickBooks to create financial reports. These include profit and loss statements and balance sheets.

- Gather documents: Collect all necessary tax documents. This includes W-2s, 1099s, and receipts.

- Consult a professional: Consider hiring a tax professional. They can review your records and ensure everything is correct.

- File electronically: Use QuickBooks to file your taxes online. This is faster and more convenient.

Filing taxes accurately is important. QuickBooks helps you stay organized and compliant.

Advanced Features

QuickBooks offers a range of advanced features that can greatly benefit small businesses. These features help streamline operations, save time, and improve accuracy. In this section, we explore some of the key advanced features of QuickBooks.

Integrations With Other Tools

QuickBooks seamlessly integrates with many other tools. This integration helps small businesses manage their operations more efficiently. Here are some popular integrations:

- Payroll Software: Integrate with payroll tools to manage employee payments.

- CRM Systems: Sync with customer relationship management (CRM) software to keep client data up-to-date.

- Inventory Management: Connect with inventory tools for real-time stock tracking.

- Payment Gateways: Link with payment processors for smoother transactions.

These integrations can greatly reduce manual data entry and errors. They also provide a more unified view of your business operations.

Automating Tasks

QuickBooks allows for extensive automation of tasks. Automation can save small businesses a lot of time. Here are some tasks that can be automated:

- Invoicing: Set up recurring invoices to be sent automatically.

- Expense Tracking: Automatically categorize expenses based on predefined rules.

- Bank Reconciliation: Automate the process of matching bank transactions with accounting records.

- Reports: Schedule reports to be generated and sent to your email.

By automating these tasks, small businesses can focus more on growth and less on administrative work. This makes the workflow smoother and more efficient.

Credit: brunswickcc.edu

Tips And Best Practices

QuickBooks is a powerful tool for small businesses. Implementing the right tips and best practices can help you make the most of it. Here, we will cover key strategies to enhance security, and ways to maximize efficiency.

Security Measures

Security is crucial for any business. QuickBooks offers various tools to keep your data safe.

- Use Strong Passwords: Create complex passwords with a mix of letters, numbers, and symbols.

- Two-Factor Authentication: Enable this feature for an extra layer of security.

- Regular Backups: Schedule automatic backups to avoid data loss.

- Access Control: Limit access to sensitive information by setting user permissions.

Maximizing Efficiency

QuickBooks can significantly boost your business efficiency. Here are some best practices:

- Automate Transactions: Set up recurring transactions to save time.

- Use Bank Feeds: Connect your bank accounts to QuickBooks for real-time updates.

- Customize Invoices: Personalize your invoices to reflect your brand.

- Track Expenses: Use the expense tracking feature to monitor your spending.

- Run Reports: Generate financial reports regularly to stay on top of your finances.

Implementing these tips and best practices can make QuickBooks an invaluable tool for your small business. Stay secure and work efficiently to achieve your business goals.

Credit: www.business.com

Frequently Asked Questions

What Is Quickbooks For Small Business?

QuickBooks is accounting software for small businesses. It helps manage finances, invoicing, and expenses easily.

Is Quickbooks Easy To Use For Beginners?

Yes, QuickBooks is user-friendly. It offers tutorials and support. Perfect for small business owners.

Can Quickbooks Handle Payroll For My Small Business?

Yes, QuickBooks can manage payroll. It calculates wages and taxes. Helps ensure timely payments.

Conclusion

QuickBooks offers invaluable help for small businesses. It simplifies accounting tasks efficiently. With user-friendly features, you manage finances easily. Time-saving automation reduces errors and boosts productivity. Support and resources ensure smooth usage. QuickBooks adapts to growth, making it a solid choice.

Small businesses gain clarity on financial health. Consider QuickBooks for managing your business finances effectively.